GOOGLEFINANCE Best Practices

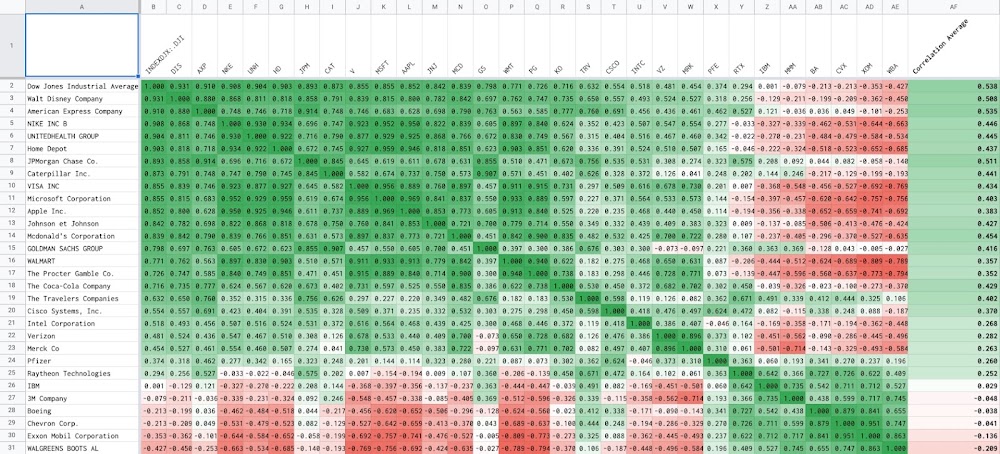

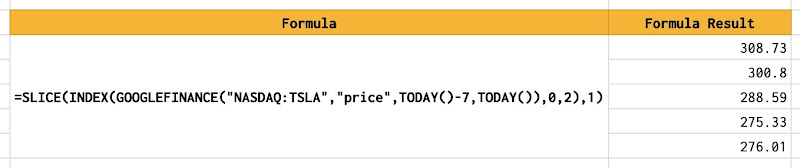

Anyone using Google Sheets to manage stock portfolio investment must know how to use the GOOGLEFINANCE function to fetch historical prices of stocks. As I have used it extensively to manage my stock portfolio investment in Google Sheets , I have learned several best practices for using the GOOGLEFINANCE function that I would like to share in this post.