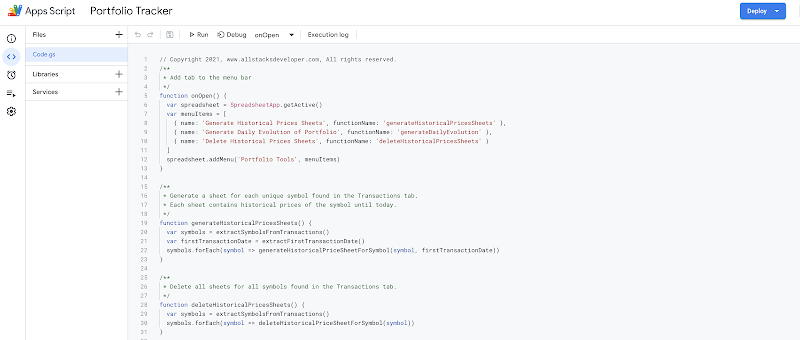

Compute cost basis of stocks with LIFO method in Google Sheets

The Last In, First Out (LIFO) method is an accounting method used to calculate the cost basis of a stock portfolio. It is the opposite of the First In, First Out (FIFO) method, where the oldest shares are sold first. In the LIFO method, the most recent shares are sold first. In the previous post Compute cost basis of stocks with FIFO method in Google Sheets , I explained how to implement FIFO method in Google Sheets to compute cost basis in stocks investing. In this post, I explain how to implement LIFO method in Google Sheets to compute cost basis in stocks investing.