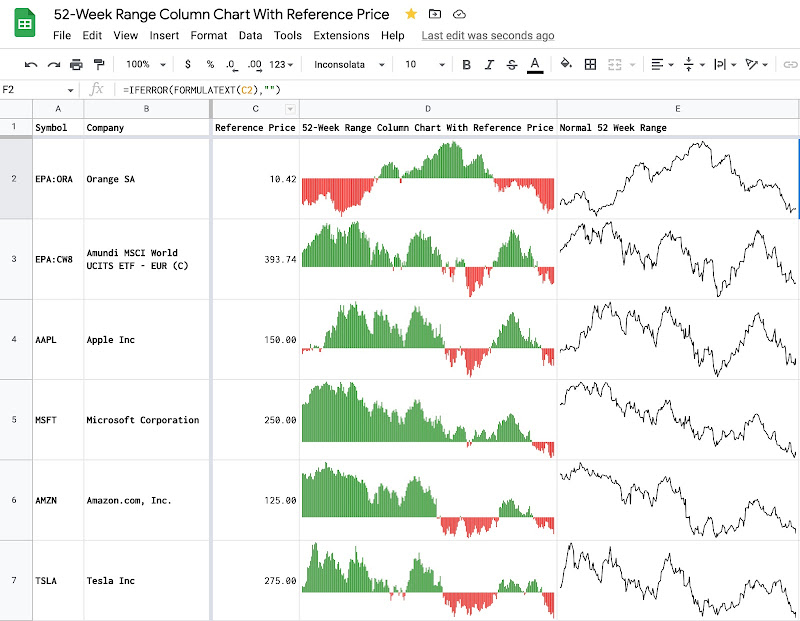

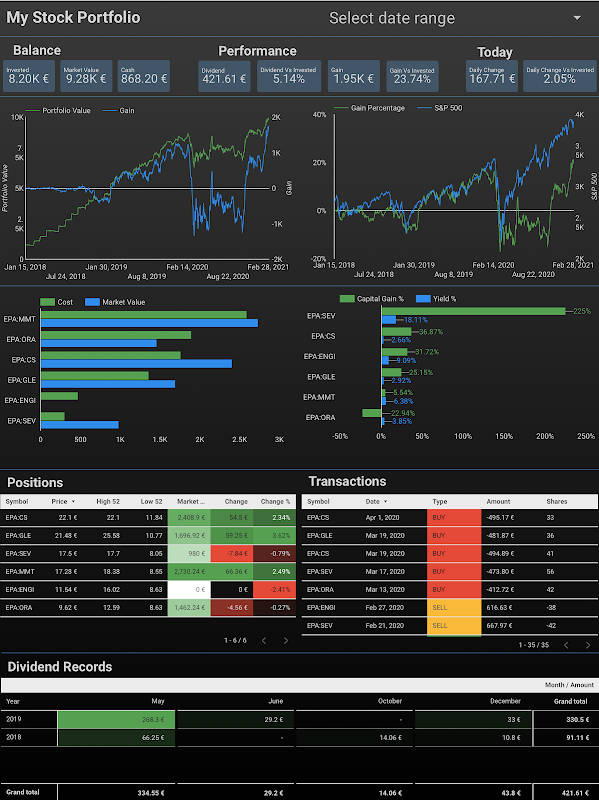

Demo stock investment portfolio tracker with Google Sheets

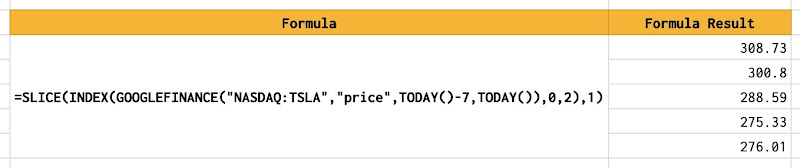

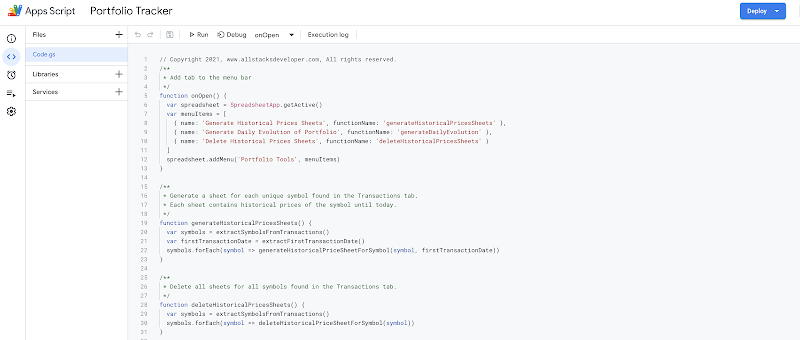

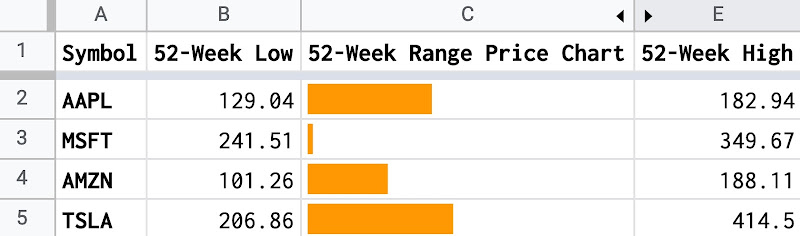

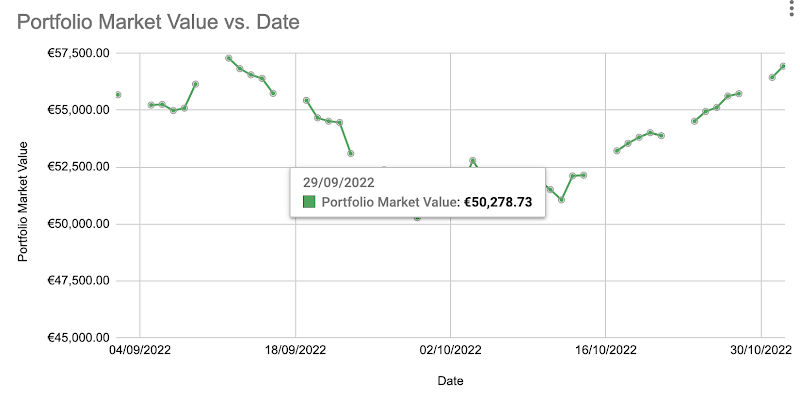

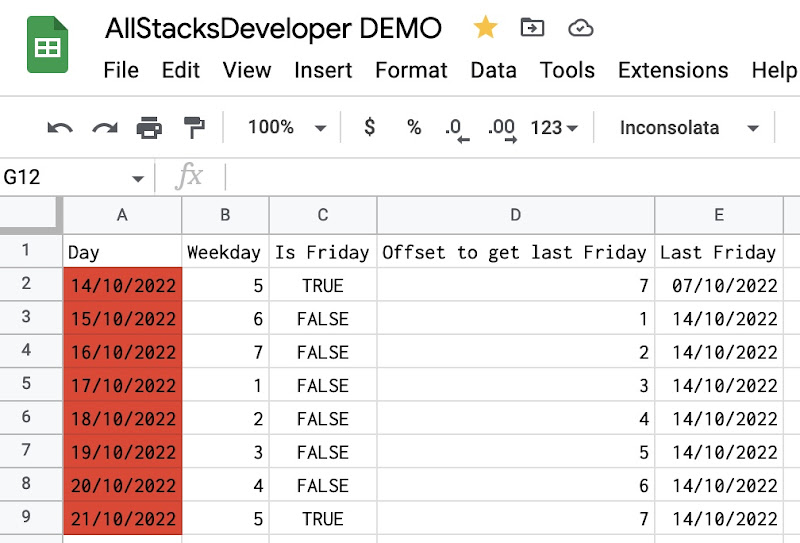

As explained in the post Create personal stock portfolio tracker with Google Sheets and Google Data Studio, a personal stock portfolio tracker consists of 2 main elements: a spreadsheet in Google Sheets and an interactive dashboard in Google Data Studio. You can take a look at the sample spreadsheet below to have an idea of how the data is organized and related. It is possible to make a copy of the spreadsheet to study it thoroughly.

NOTE: An enhanced version was published at Create personal stock portfolio tracker with Google Sheets and Google Data Studio.

Table of Contents

Make a copy

Make a copy of a stock investment portfolio tracker with Google Sheets

Note

To better understand the overall concept, please check out this post Create personal stock portfolio tracker with Google Sheets and Google Data Studio.

Disclaimer

The post is only for informational purposes and not for trading purposes or financial advice.

Feedback

If you have any feedback, question, or request please:

- leave a comment in the comment section

- write me an email to allstacksdeveloper@gmail.com

Support this blog

If you value my work, please support me with as little as a cup of coffee! I appreciate it. Thank you!

Share with your friends

If you read it this far, I hope you have enjoyed the content of this post. If you like it, share it with your friends!

Comments

Post a Comment