Compare stock investment portfolio to compound interest saving account

In investing, it is important to define the target that we want to achieve. Many investors like to compare their portfolios with a market index, but is outperforming the market index a good target? It is not a quantitative target to be measurable as market indexes fluctuate daily. I, personally, aim only for 10% growth a year. If at the end of the year, I see my portfolio grows 10%, I am pleased with that result no matter that S&P500 grows 50% the same year. To see if my stock portfolio grows in line with the 10% target, I choose to compare it to a saving account with the same interest. In this post, I will show you how to use a fictive saving account with daily compound interest as the target to benchmark a stock portfolio.

Table of Contents

Concept

All investors want to see their money grow over time. It is exactly what is offered by a saving account. If we deposit money in a saving account, that money will only grow even with a very low-interest rate. But nobody forbids us to aim for a higher interest rate, for example, 10% per year. We might not find any bank that proposes 10% per year for a saving account but we can use that imaginative saving account to indicate the target that we want to achieve with the stock portfolio. To make the target challenging, the interest in that imaginative saving account is compounded daily. Daily compound interest means the interest generated today is immediately used to generate interest for tomorrow and so on.

Computation

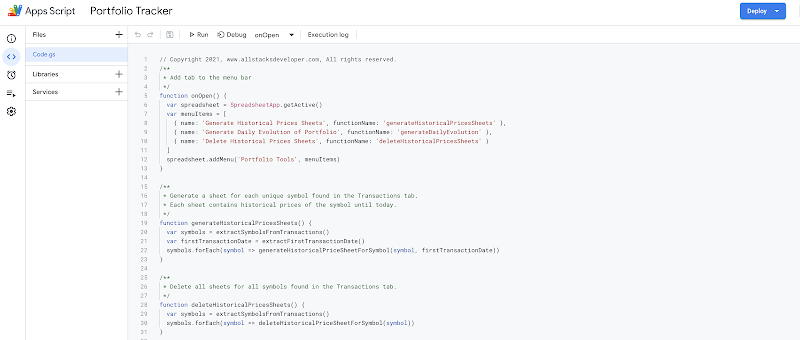

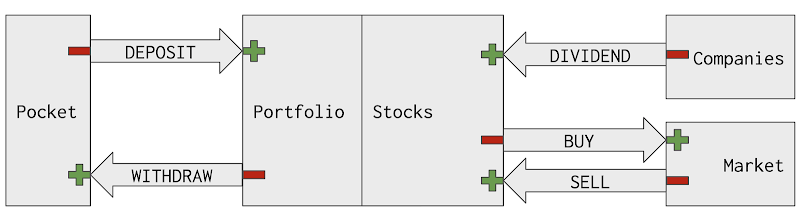

To implement this idea, we will extract all DEPOSIT and WITHDRAW transactions of the stock portfolio and apply them to the target saving account with daily compound interest. Each DEPOSIT (WITHDRAW) transaction will generate interest from the next day.

For example, the first table below shows the transactions of our stock portfolio until 05/01/2018. The second table below is the evolution of the target saving account until 08/01/2018. In this example, the target saving account has 10% annual interest, which means 10 / 365 = 0.0274% daily compound interest.

Let's go through each date to understand the computation:

- As we apply only DEPOSIT/WITHDRAW transactions to the target saving account, any BUY/SELL/DIVIDEND transaction will be ignored.

- On 27/12/2017, we deposited 180 euros for the first time. As the deposit generates interest from the next day, we had so 0 euros of interest on the first day. As a result, the invested and saving balance were both 180 euros.

- On 28/12/2017, we deposited 1000 euros. With 0.0274% daily interest, the 180 euros previous saving balance generated 0.049 euros saving interest. We had so 180 euros previous saving balance, 1000 euros cash flow, and 0.049 euros saving interest. Totally, it made up 1180.049 euros as a new saving balance.

- On 29/12/2017, we deposited 0 euros. With 0.0274% daily interest, the 1180.049 euros previous saving balance generated 0.323 euros saving interest. We had so 1180.049 euros previous saving balance, 0 euros cash flow, and 0.323 euros saving interest. Totally, it made up 1180.373 euros as a new saving balance.

- On 30/12/2017, we deposited 0 euros. With 0.0274% daily interest, the 1180.373 euros previous saving balance generated 0.323 euros saving interest. We had so 1180.373 euros previous saving balance, 0 euros cash flow, and 0.323 euros saving interest. Totally, it made up 1180.696 euros as a new saving balance.

- On 03/01/2018, we deposited 1000 euros. With 0.0274% daily interest, the 1181.667 euros previous saving balance generated 0.324 euros saving interest. We had so 1181.667 euros previous saving balance, 1000 euros cash flow, and 0.324 euros saving interest. Totally, it made up 2181.990 euros as a new saving balance.

- On 04/01/2018, we deposited 0 euros. With 0.0274% daily interest, the 2181.990 euros previous saving balance generated 0.598 euros saving interest. We had so 2181.990 euros previous saving balance, 0 euros cash flow, and 0.598 euros saving interest. Totally, it made up 2182.588 euros as a new saving balance.

The target saving account's evolution is computed easily with LION stock portfolio tracker.

Visualization

After defining the target, we need to keep the stock portfolio on track with that target. To do so, a simple thing we can do is to plot the evolution of the stock portfolio and the target saving account on the same time series chart. As shown in the LION stock portfolio tracker:

- On one chart, we can plot the Invested, the Portfolio Value, and the Saving Balance.

- On another chart, we can plot the Portfolio Gain and the Saving Gain.

As we can see in the below 3 examples:

- The Saving Balance line is always above the Invested line. If the Portfolio Value line is above the Invested line, the stock portfolio is generating money. If the Portfolio Value line is above the Saving Balance, the stock portfolio is on track with the target.

- The Saving Gain is always above the 0 line and grows gradually thanks to daily compound interest. If the Portfolio Gain line is above the Saving Gain line, the stock portfolio is on track with the target.

Evolution of target saving account with 5% annual compound interest

Evolution of target saving account with 10% annual compound interest

Evolution of target saving account with 15% annual compound interest

Conclusion

By using Google Sheets, Apps Script, and Google Data Studio, we can evaluate the stock portfolio's performance vs a target saving account with compound interest. We have seen the significance of compound interest when it is computed daily. On a time series chart, we can identify when the portfolio loses track of the target saving account and hence make adjustments in investment strategy to improve the performance.

Disclaimer

The post is only for informational purposes and not for trading purposes or financial advice.

Feedback

If you have any feedback, question, or request please:

- leave a comment in the comment section

- write me an email to allstacksdeveloper@gmail.com

Support this blog

If you value my work, please support me with as little as a cup of coffee! I appreciate it. Thank you!

Share with your friends

If you read it this far, I hope you have enjoyed the content of this post. If you like it, share it with your friends!

Comments

Post a Comment