Demo stock investment portfolio tracker with Google Sheets and Google Data Studio

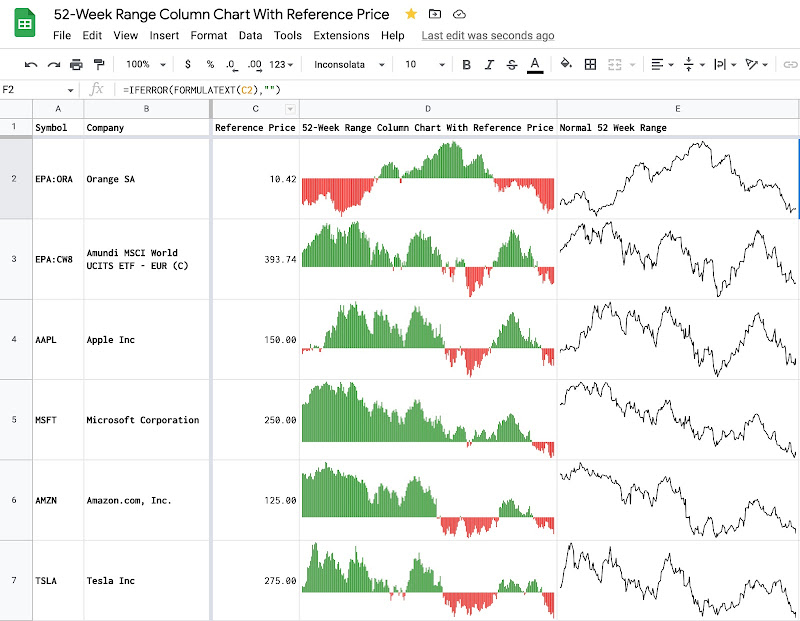

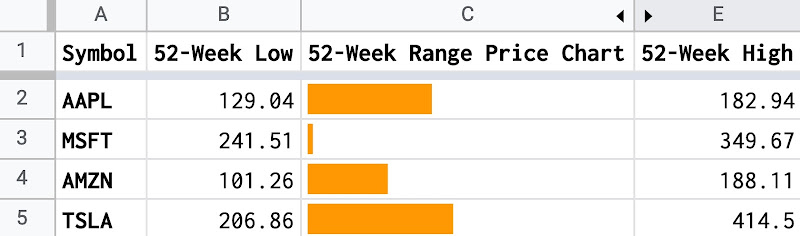

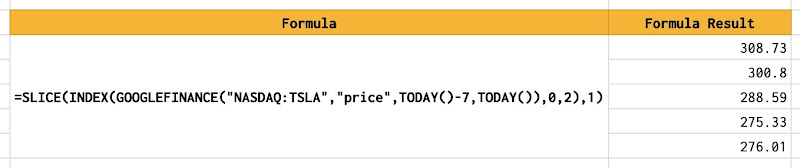

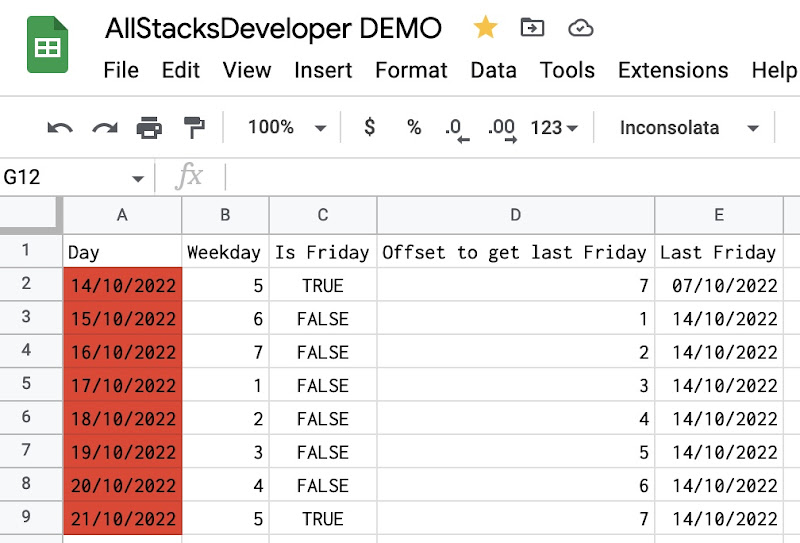

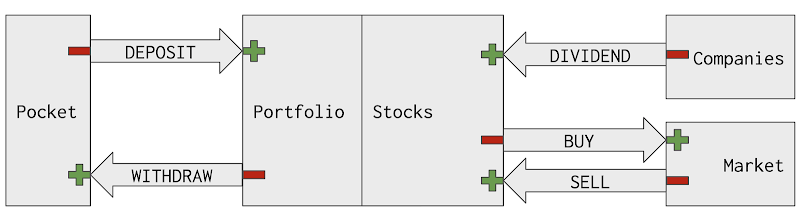

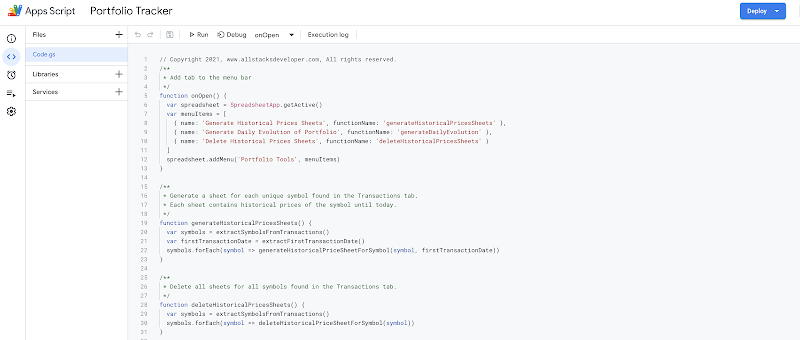

I am happy to announce the release of LION stock portfolio tracker. It is a personal stock portfolio tracker built with Google Sheets and Google Data Studio. The stock portfolio's transactions are managed in Google Sheets and its performance is monitored interactively on a beautiful dashboard in Google Data Studio.

You can try with the demo below and follow the LION stock portfolio tracker guide to create your own personal stock portfolio tracker with Google Sheets and Google Data Studio.

Table of Contents

Demo dashboard

Demo spreadsheet

Guide

Disclaimer

The post is only for informational purposes and not for trading purposes or financial advice.

Feedback

If you have any feedback, question, or request please:

- leave a comment in the comment section

- write me an email to allstacksdeveloper@gmail.com

Support this blog

If you value my work, please support me with as little as a cup of coffee! I appreciate it. Thank you!

Share with your friends

If you read it this far, I hope you have enjoyed the content of this post. If you like it, share it with your friends!

Exactly what I have been looking for! You are amazing buddy!! Is it possible to include XIRR at individual stock level for comparison purposes. I could add overall portfolio XIRR, but couldn't get it calculated at stock level.

ReplyDeleteThank you for your feedback and suggestion!

DeleteIt's the first time I hear about XIRR. I'll learn about it and see if I can add it to the stock portfolio tracker. If so, I'll publish a new post for it.

Hi, I hope you are doing well!

DeleteI just want to let you know that thanks to your suggestion, I just published a series of posts about how to use XIRR and XNPV functions in Google Sheets to calculate the internal rate of return (IRR) and the net present value (NPV) of a stock portfolio at different levels (stock level and portfolio level).

Please check them out below. Enjoy reading and thanks again for your suggestion!

https://www.allstacksdeveloper.com/2021/12/time-value-of-money-pv-fv-npv-irr.html

https://www.allstacksdeveloper.com/2022/01/how-to-calculate-the-internal-rate-of-return-IRR-and-the-net-present-value-NPV-of-a-stock-portfolio-with-google-sheets.html

https://www.allstacksdeveloper.com/2022/01/how-to-use-XIRR-XNPV-functions-to-calculate-irr-npv-of-a-stock-portfolio.html